Analyzing the Impact of Student Debt on College Completion Rates

The cost of pursuing a higher education has steadily increased over the years, creating financial challenges for students and families alike. Tuition fees, textbooks, housing, and other academic expenses have all contributed to the rising financial burden placed on those seeking to further their education.

As colleges and universities continue to face budget constraints and resource challenges, the burden often falls on students to cover the rising costs. This trend has led to a growing concern about the accessibility of higher education for individuals from diverse socioeconomic backgrounds. The increasing financial strain has also prompted discussions about the long-term implications for students in terms of student loan debt and the ability to pay off these financial obligations post-graduation.

• The cost of tuition fees has increased significantly over the years

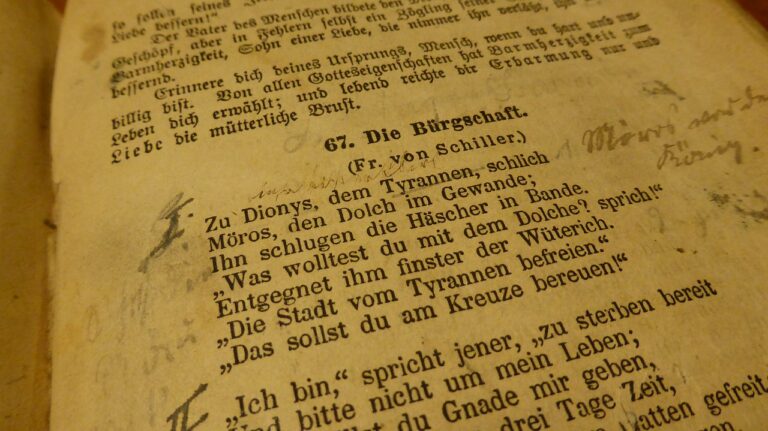

• Textbooks and academic expenses also add to the financial burden on students

• Housing costs for students attending college have also risen, making it harder for some to afford higher education

• Budget constraints and resource challenges faced by colleges contribute to the rising costs for students

The Burden of Student Loan Debt

When it comes to pursuing higher education, student loans have become an inevitable part of the equation for many students. As tuition costs continue to rise, students are increasingly relying on loans to fund their education. While these loans can provide the necessary financial support in the short term, the long-term burden of repaying them can be overwhelming for many graduates.

The weight of student loan debt can have far-reaching implications beyond just financial concerns. It can impact graduates’ ability to achieve other life milestones, such as buying a home, starting a family, or saving for retirement. The stress and anxiety associated with carrying a large amount of debt can also affect graduates’ mental well-being, leading to feelings of uncertainty and insecurity about their future.

Financial Barriers to College Completion

Access to higher education is a fundamental component of socioeconomic mobility and personal growth. However, many students encounter significant financial barriers that hinder their ability to complete their college education. The rising costs of tuition, textbooks, and living expenses pose a considerable challenge for students from low-income backgrounds, often leading to financial strain and increased levels of debt.

Additionally, limited access to financial aid and scholarships further exacerbates the financial obstacles faced by many students. As tuition fees continue to soar, individuals who are unable to secure sufficient financial assistance may find themselves forced to forego their dream of obtaining a college degree. Ultimately, addressing these financial barriers is crucial in ensuring that all students have equal opportunities to pursue and successfully complete their higher education aspirations.

Why is the cost of higher education increasing?

The cost of higher education is increasing due to a variety of factors, including inflation, cuts in state funding for public universities, and the growing demand for advanced degrees in the workforce.

How does student loan debt impact college completion rates?

Student loan debt can be a significant barrier to college completion, as students may be forced to drop out due to financial strain or spend less time on their studies in order to work enough to pay off their loans.

What are some common financial barriers to college completion?

Common financial barriers to college completion include tuition and fees, textbooks and supplies, housing and food expenses, transportation costs, and unexpected emergencies.

How can students overcome financial barriers to college completion?

Students can overcome financial barriers to college completion by applying for scholarships and grants, working part-time or taking out loans responsibly, budgeting and saving money, and seeking support from financial aid offices and student support services.

What are some long-term consequences of not completing college due to financial barriers?

Some long-term consequences of not completing college due to financial barriers include lower earning potential, limited job opportunities, increased likelihood of defaulting on student loans, and lack of access to career advancement opportunities.