Promoting Financial Literacy Through Real-World Applications

Financial literacy plays a fundamental role in empowering individuals to manage their personal finances efficiently. Understanding basic financial concepts enables individuals to make informed decisions regarding saving, investing, and budgeting. Without this knowledge, individuals may struggle to navigate the complex world of personal finance, leading to financial instability and poor money management.

Moreover, being financially literate equips individuals with the skills to plan for the future and make sound financial decisions. By mastering financial fundamentals, individuals can create sustainable financial plans, set achievable goals, and work towards financial security and independence. In today’s society, where financial decisions impact various aspects of daily life, possessing financial literacy is more important than ever.

The Impact of Financial Literacy on Everyday Life

Financial literacy plays a crucial role in shaping individual’s everyday life. Understanding financial concepts allows people to make informed decisions about their money, leading to greater financial stability. From managing personal expenses to planning for future goals, financial literacy equips individuals with the necessary knowledge to navigate the complexities of money management.

Moreover, being financially literate enables individuals to protect themselves from fraud and scams. By understanding the basics of financial transactions and recognizing potential red flags, individuals can safeguard their assets and prevent falling victim to financial exploitation. This empowerment through knowledge not only enhances financial well-being but also promotes overall confidence in managing one’s financial affairs.

• Financial literacy allows individuals to make informed decisions about their money

• Helps in managing personal expenses and planning for future goals

• Equips individuals with necessary knowledge to navigate complexities of money management

• Protects individuals from fraud and scams

• Enables recognition of potential red flags in financial transactions

• Safeguards assets and prevents falling victim to financial exploitation

Financial literacy not only impacts an individual’s financial well-being but also plays a significant role in promoting overall confidence in managing one’s financial affairs. By educating oneself on financial concepts, one can take control of their finances and work towards achieving long-term financial security. In today’s complex economic environment, the importance of being financially literate cannot be overstated.

Practical Tips for Budgeting and Saving Money

One effective method for managing your finances is to create a monthly budget. Start by tracking your income and expenses to get a clear picture of where your money is going. Categorize your expenses into needs (such as rent, groceries, and utilities) and wants (like dining out and entertainment), then allocate a specific amount for each category. Be realistic and flexible with your budget, making adjustments as needed to stay on track.

Another practical tip for saving money is to cut back on unnecessary expenses. Look for areas where you can reduce costs, such as cancelling unused subscriptions, shopping for discounts, or cooking meals at home instead of eating out. Small changes in your spending habits can add up over time and help you build up your savings. Additionally, consider setting up automatic transfers to a savings account to make saving money a regular and consistent habit.

Why is financial literacy important?

Financial literacy is important because it helps individuals make informed decisions about their finances, such as budgeting, saving, investing, and managing debt. It empowers people to take control of their financial futures and avoid common pitfalls like overspending and debt.

How does financial literacy impact everyday life?

Financial literacy impacts everyday life by enabling individuals to make wise financial decisions that affect their quality of life. It can lead to better money management, increased savings, reduced stress, and improved overall financial well-being.

What are some practical tips for budgeting and saving money?

Some practical tips for budgeting and saving money include creating a budget, tracking expenses, setting financial goals, prioritizing needs over wants, cutting unnecessary expenses, automating savings, and seeking ways to increase income.

How can I improve my financial literacy?

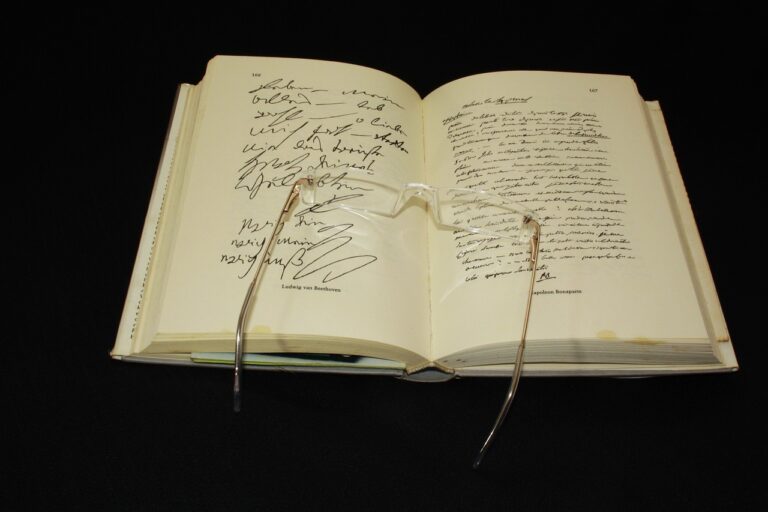

You can improve your financial literacy by educating yourself about personal finance topics, such as budgeting, saving, investing, and managing debt. There are various resources available, such as books, online articles, workshops, and financial literacy courses.

What are the benefits of budgeting and saving money?

The benefits of budgeting and saving money include better financial security, reduced stress, improved financial health, increased financial independence, and the ability to reach long-term financial goals. It also allows for better preparation for unexpected expenses or emergencies.